Table of Contents

Health insurance policies in the UK offer numerous benefits, providing individuals and families with access to private healthcare, shorter waiting times, and additional services that may not be available through the National Health Service (NHS).(Health Insurance Policy Benefits in the UK) Below is a detailed article covering the benefits of health insurance policies in the UK, along with answers to frequently asked questions (FAQs).

What is Health Insurance?

Health insurance is a policy that covers the cost of private medical treatment for acute conditions. It allows policyholders to receive faster access to healthcare services, consultations, specialist treatments, and sometimes even alternative therapies.

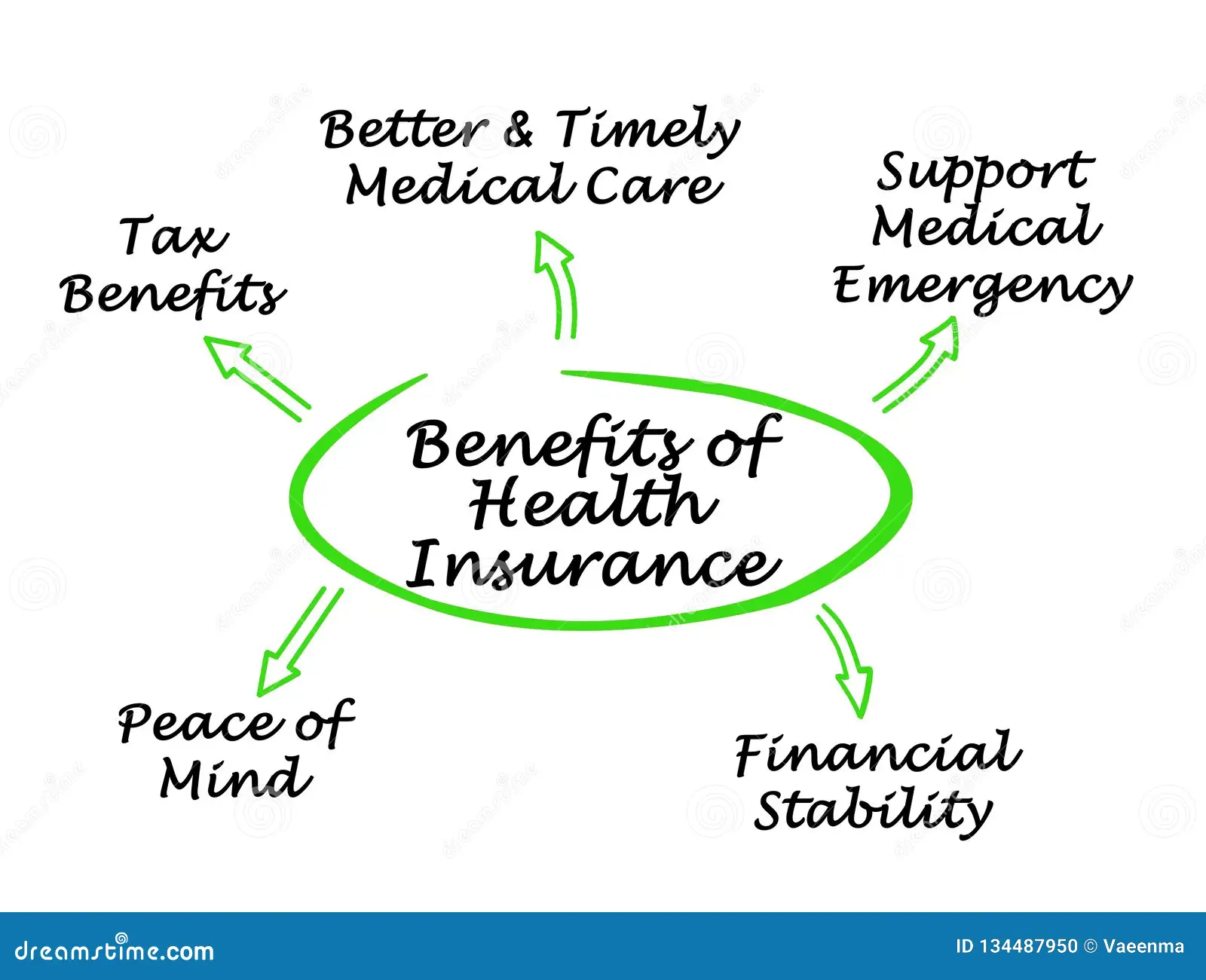

Benefits of Health Insurance in the UK.

1.Shorter Waiting Times.(Health Insurance Policy Benefits in the UK)

One of the main reasons people opt for private health insurance is to avoid long NHS waiting times. With private health insurance, individuals can often get quicker appointments and faster access to specialists.

2.Choice of Hospitals and Specialists.

Policyholders have the flexibility to choose their hospital and specialist, which can be beneficial for those looking for a specific consultant or treatment facility.

3.Private Hospital Rooms.(Health Insurance Policy Benefits in the UK)

Unlike NHS hospitals, where patients may have to share rooms, private health insurance usually covers private en-suite rooms, offering more comfort and privacy during treatment and recovery.

4.Access to Specialist Treatments and Drugs.

Private health insurance often provides access to specialist treatments, drugs, and therapies that may not be available on the NHS due to cost restrictions.

5.Physiotherapy and Rehabilitation.

Many policies cover physiotherapy, rehabilitation, and other therapies such as chiropractic and osteopathy,(Health Insurance Policy Benefits in the UK)

which can aid in faster recovery.

6.Mental Health Support.

Health insurance policies may include mental health treatment, covering therapy sessions and psychiatric consultations, which can be difficult to access through the NHS due to high demand.

7.Cancer Treatment.

Some policies cover advanced cancer treatments, including radiotherapy, chemotherapy, and access to innovative drugs that may not be readily available through the NHS.

8.Dental and Optical Cover.

Some insurance policies offer additional coverage for routine dental and optical care, including eye tests, prescription glasses, and dental check-ups.

9. 24/7 Health Helplines.(Health Insurance Policy Benefits in the UK)

Many insurers provide access to 24/7 health helplines staffed by medical professionals who can offer guidance and support on health-related concerns.

10. Overseas Medical Treatment.

Some policies offer coverage for emergency medical treatment while traveling abroad, which can be invaluable for frequent travelers.

FAQs About Health Insurance in the UK.

1.Do I Need Private Health Insurance in the UK?

Private health insurance is not mandatory in the UK since the NHS provides free healthcare services. However, individuals may choose to take out private health insurance to gain access to faster treatment, specialist consultations, and private healthcare facilities.

2. How Much Does Health Insurance Cost in the UK?

The cost of health insurance varies depending on factors such as age, medical history, lifestyle, level of coverage, and the insurer. On average, premiums range from £50 to £200 per month for individual policies.

3.What Does a Typical Health Insurance Policy Cover?

A standard policy typically covers consultations, diagnostic tests, hospital treatment, surgery, inpatient and outpatient care, mental health support, and cancer treatment. Optional extras like dental and optical cover may be available at an additional cost.

4.What is Not Covered by Health Insurance?

- Health insurance usually does not cover:

- Preexisting medical conditions.(Health Insurance Policy Benefits in the UK)

- Chronic illnesses (e.g., diabetes, asthma)

- Emergency care (NHS A&E services remain the primary provider for emergencies)

- Maternity and pregnancy care (unless complications arise)

- Cosmetic surgeries (unless medically necessary)

5.Can I Get Health Insurance If I Have Pre existing Conditions?

Most insurers exclude pre-existing conditions from coverage. However, some insurers may offer coverage after a set waiting period or at an increased premium.

6.Is Health Insurance Tax Deductible in the UK?

For individuals, private health insurance is not tax-deductible. However, businesses that provide health insurance as part of employee benefits may receive tax advantages.

7.Can I Use My Health Insurance Alongside the NHS?

Yes, private health insurance complements NHS services. Individuals can still use the NHS for treatments not covered by their policy while benefiting from private healthcare for faster access to services.

8.Do Employers Offer Health Insurance?

Health Insurance Policy Benefits in the UK. Many employers offer private health insurance as part of employee benefits. These policies often provide comprehensive coverage and may be subsidized by the employer.

9.What Are the Best Health Insurance Providers in the UK?

Some of the leading health insurance providers in the UK include:

- Bupa.

- AXA PPP Healthcare.

- Aviva.

- Vitality Health.

- Cigna.

- WPA. (Western Provident Association)

10.How Can I Choose the Right Health Insurance Plan?

- When choosing a health insurance policy, consider the following factors:

- Level of coverage required (basic, comprehensive, or specialist coverage).

- Monthly premiums and potential out-of-pocket costs.

- Exclusions and limitations of the policy.

- Hospital and specialist options available.

- Additional benefits like dental and mental health support.

Conclusion.

Private health insurance in the UK provides a range of benefits, including faster treatment times, access to specialists, and additional healthcare services that may not be available through the NHS. While it is not a necessity, having a policy can be advantageous for those who seek quicker access to medical treatment and greater flexibility in healthcare choices. (Health Insurance Policy Benefits in the UK) Before purchasing a policy, individuals should carefully review the terms, costs, and coverage options to ensure they select the best plan suited to their needs. Whether through personal policies or employer-provided plans, private health insurance can be a valuable investment in one’s health and well being.